# setwd('C:/R-Project/DAT/Regression/')chapter 3, chapter 4

library(ggplot2)Data

dt <- data.frame(x = c(4,8,9,8,8,12,6,10,6,9),

y = c(9,20,22,15,17,30,18,25,10,20))

dt| x | y |

|---|---|

| <dbl> | <dbl> |

| 4 | 9 |

| 8 | 20 |

| 9 | 22 |

| 8 | 15 |

| 8 | 17 |

| 12 | 30 |

| 6 | 18 |

| 10 | 25 |

| 6 | 10 |

| 9 | 20 |

correlation check

cor(dt$x, dt$y)

0.921812343945765

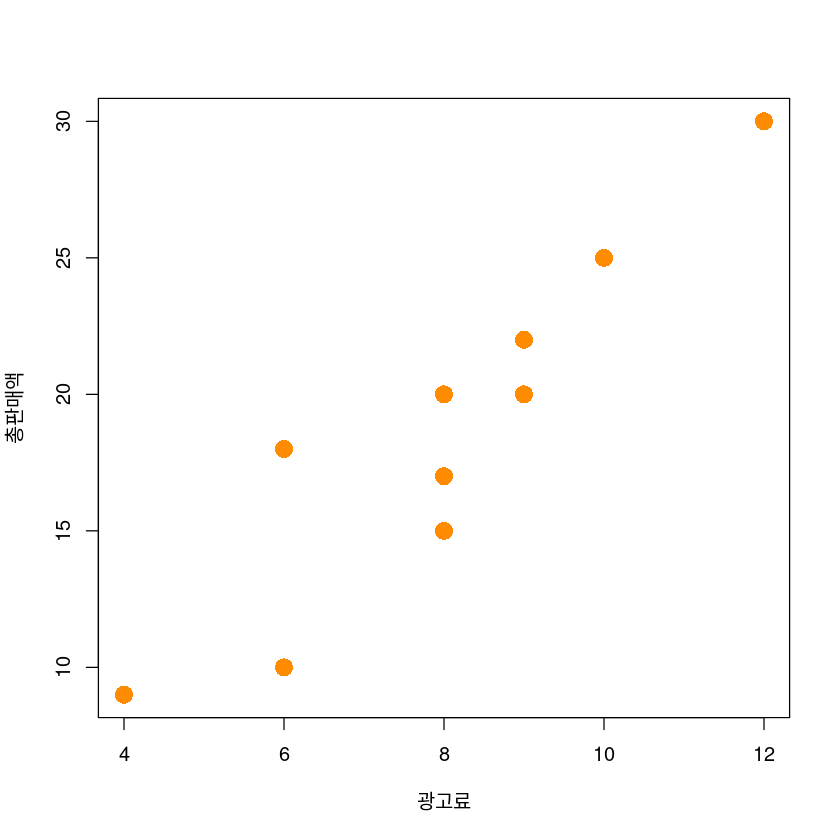

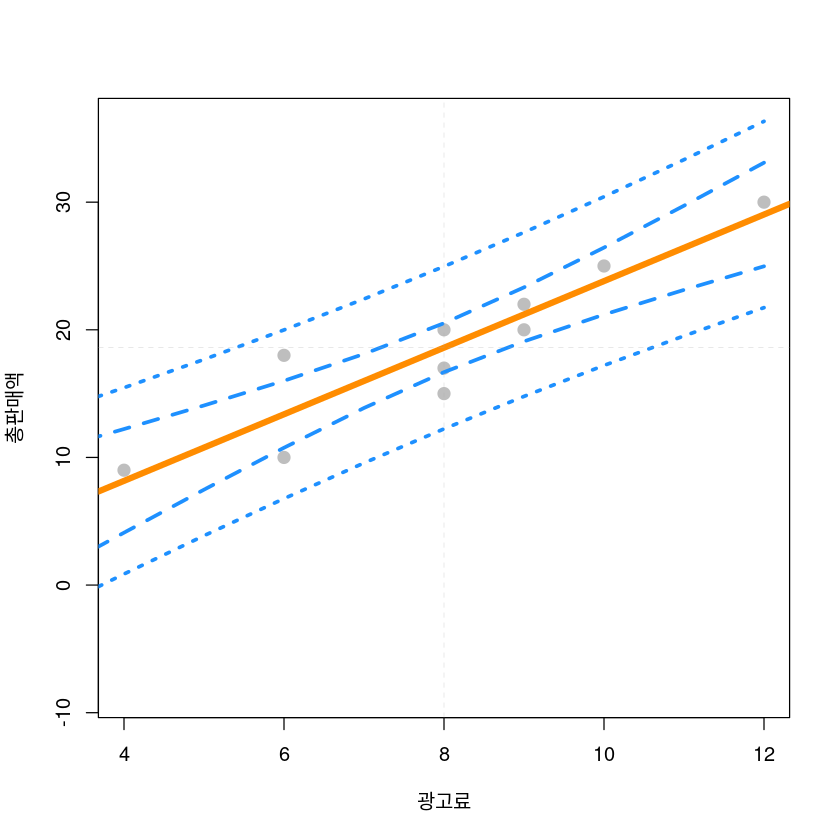

산점도 확인

plot(y~x,

data = dt,

xlab = "광고료",

ylab = "총판매액",

pch = 16,

cex = 2,

col = "darkorange")

pch 점 모양

cex 점 크기

양의상관관계 강하네,

우상향이네, 단순상관선형 적용해보면 되겠다.

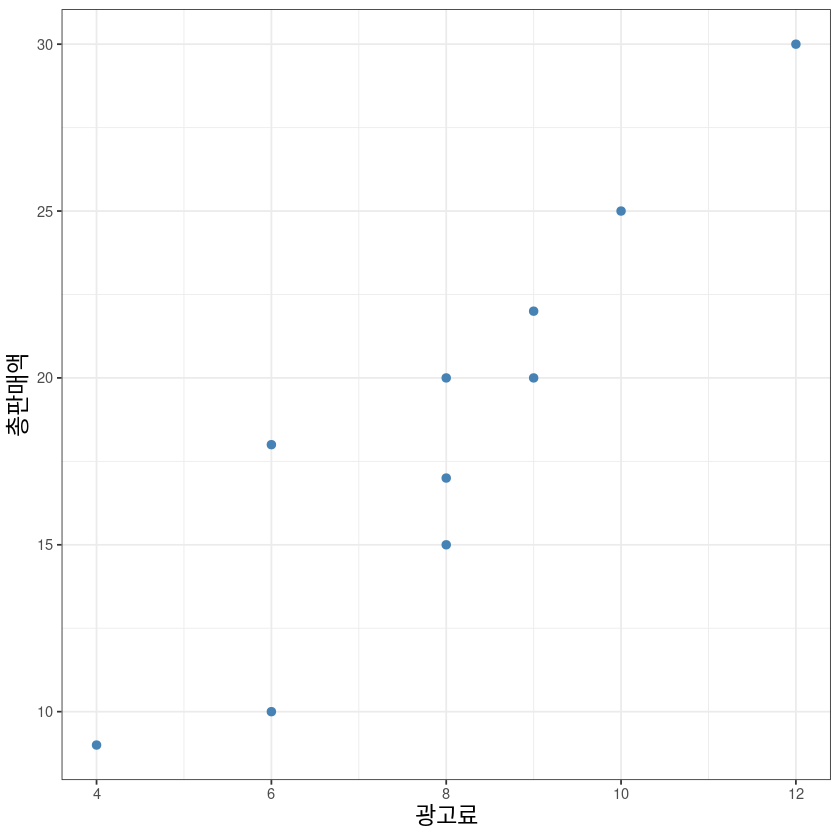

ggplot(dt, aes(x, y)) +

geom_point(col='steelblue', lwd=2) +

# geom_abline(intercept = co[1], slope = co[2], col='darkorange', lwd=1.2) +

xlab("광고료")+ylab("총판매액")+

# scale_x_continuous(breaks = seq(1,10))+

theme_bw() +

theme(axis.title = element_text(size = 14))

적합

모형 적합을 한다 yhat을 찾는다. - 회귀분석을 한다. 평균 반응을 추정한다.

lm linear model 사용

## y = beta0 + beta1*x + epsilon

model1 <- lm(y ~ x, dt)

# lm(y ~ 0 + x, dt) beta0 없이 분석하고 싶을때

model1

Call:

lm(formula = y ~ x, data = dt)

Coefficients:

(Intercept) x

-2.270 2.609 설명변수 x 하나일때

- beta0hat = -2.270

- beta1hat = 2.609

summary(model1)

Call:

lm(formula = y ~ x, data = dt)

Residuals:

Min 1Q Median 3Q Max

-3.600 -1.502 0.813 1.128 4.617

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -2.2696 3.2123 -0.707 0.499926

x 2.6087 0.3878 6.726 0.000149 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 2.631 on 8 degrees of freedom

Multiple R-squared: 0.8497, Adjusted R-squared: 0.831

F-statistic: 45.24 on 1 and 8 DF, p-value: 0.0001487- 모형의 유의성 검정 자체(f검정)

- 개별 회귀계수에 대한 유의성검정(t검정)

- beta1은 유의하지 않다

- beta0는 유의하다

- f통계량은 45.24(msr/mse) p값 충분히 작아서 모형은 유의하다.

- y의 총 변동 중에 85%정도를 설명하고 있다.

- root mse(RMSE) = 2.631

6.726**2

45.239076

단순선형에서만 해당

0.000149도 같음

names(model1)- 'coefficients'

- 'residuals'

- 'effects'

- 'rank'

- 'fitted.values'

- 'assign'

- 'qr'

- 'df.residual'

- 'xlevels'

- 'call'

- 'terms'

- 'model'

model1$residuals # 보고 싶은 변수 입력해봐~- 1

- 0.834782608695656

- 2

- 1.4

- 3

- 0.791304347826087

- 4

- -3.6

- 5

- -1.6

- 6

- 0.96521739130435

- 7

- 4.61739130434782

- 8

- 1.18260869565217

- 9

- -3.38260869565218

- 10

- -1.20869565217391

model1$fitted.values ##hat y

model1$coefficients- 1

- 8.16521739130434

- 2

- 18.6

- 3

- 21.2086956521739

- 4

- 18.6

- 5

- 18.6

- 6

- 29.0347826086957

- 7

- 13.3826086956522

- 8

- 23.8173913043478

- 9

- 13.3826086956522

- 10

- 21.2086956521739

- (Intercept)

- -2.2695652173913

- x

- 2.60869565217391

anova(model1) ## 회귀모형의 유의성 검정| Df | Sum Sq | Mean Sq | F value | Pr(>F) | |

|---|---|---|---|---|---|

| <int> | <dbl> | <dbl> | <dbl> | <dbl> | |

| x | 1 | 313.04348 | 313.043478 | 45.24034 | 0.0001486582 |

| Residuals | 8 | 55.35652 | 6.919565 | NA | NA |

- 설명변수의 개수가 x 자유도

- 잔차의 자유도는 n-2

a <- summary(model1)

ls(a)- 'adj.r.squared'

- 'aliased'

- 'call'

- 'coefficients'

- 'cov.unscaled'

- 'df'

- 'fstatistic'

- 'r.squared'

- 'residuals'

- 'sigma'

- 'terms'

summary(model1)$coef ## 회귀계수의 유의성 검정| Estimate | Std. Error | t value | Pr(>|t|) | |

|---|---|---|---|---|

| (Intercept) | -2.269565 | 3.212348 | -0.7065129 | 0.4999255886 |

| x | 2.608696 | 0.387847 | 6.7260939 | 0.0001486582 |

confint(model1, level = 0.95) ##회귀계수의 신뢰구간

## beta +- t_alpha/2 (n-2) * se(beta)

qt(0.025, 8)

qt(0.975, 8)| 2.5 % | 97.5 % | |

|---|---|---|

| (Intercept) | -9.677252 | 5.138122 |

| x | 1.714319 | 3.503073 |

-2.30600413520417

2.30600413520417

- qt _ tquantile

## y = beta1*x + epsilon

model2 <- lm(y ~ 0 + x, dt)

summary(model2)

Call:

lm(formula = y ~ 0 + x, data = dt)

Residuals:

Min 1Q Median 3Q Max

-4.0641 -1.5882 0.2638 1.4818 3.9359

Coefficients:

Estimate Std. Error t value Pr(>|t|)

x 2.3440 0.0976 24.02 1.8e-09 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 2.556 on 9 degrees of freedom

Multiple R-squared: 0.9846, Adjusted R-squared: 0.9829

F-statistic: 576.8 on 1 and 9 DF, p-value: 1.798e-09- intercept 없는 모습

- r squre가 두 번째가 높고,

- p값도 훨씬 유의하게 나옴

anova(model1)| Df | Sum Sq | Mean Sq | F value | Pr(>F) | |

|---|---|---|---|---|---|

| <int> | <dbl> | <dbl> | <dbl> | <dbl> | |

| x | 1 | 313.04348 | 313.043478 | 45.24034 | 0.0001486582 |

| Residuals | 8 | 55.35652 | 6.919565 | NA | NA |

anova(model2)| Df | Sum Sq | Mean Sq | F value | Pr(>F) | |

|---|---|---|---|---|---|

| <int> | <dbl> | <dbl> | <dbl> | <dbl> | |

| x | 1 | 3769.1895 | 3769.1895 | 576.8138 | 1.79763e-09 |

| Residuals | 9 | 58.8105 | 6.5345 | NA | NA |

###########

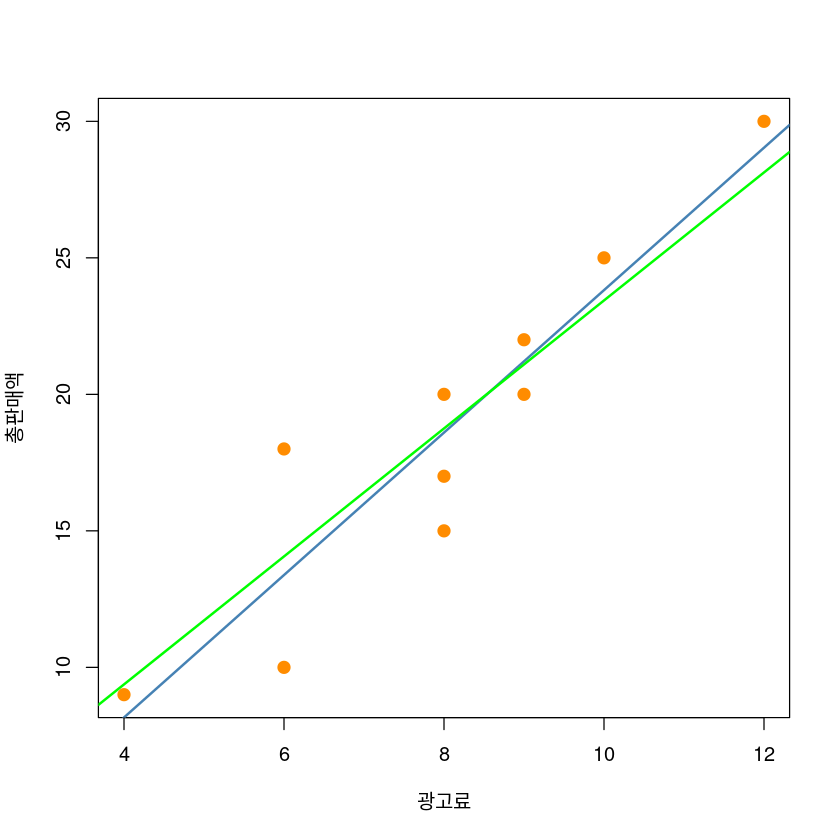

plot(y~x, data = dt,

xlab = "광고료",

ylab = "총판매액",

pch = 20,

cex = 2,

col = "darkorange")

abline(model1, col='steelblue', lwd=2)

abline(model2, col='green', lwd=2)

model들이 기울기가 살짝씩 다르다

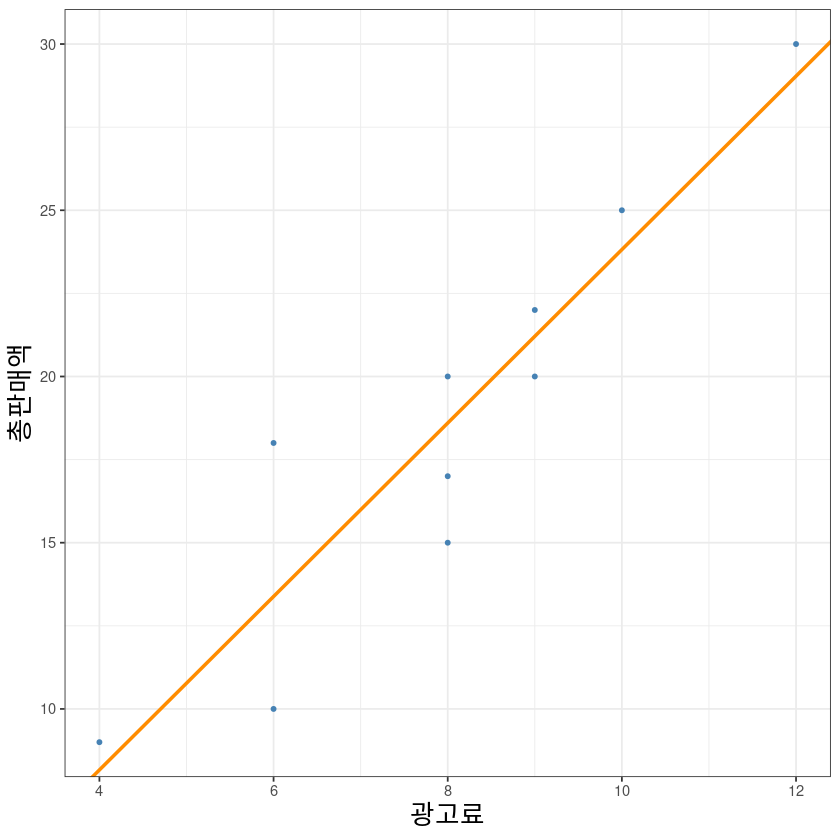

co <- coef(model1)ggplot(dt, aes(x, y)) +

geom_point(col='steelblue', lwd=1) +

geom_abline(intercept = co[1], slope = co[2], col='darkorange', lwd=1) +

xlab("광고료")+ylab("총판매액")+

theme_bw()+

theme(axis.title = element_text(size = 16))

######## LSE 구하기

# lm을 사용하지 않고 구할때

dt1 <- data.frame(

i = 1:nrow(dt),

x = dt$x,

y = dt$y,

x_barx = dt$x - mean(dt$x), # x - x평균

y_bary = dt$y - mean(dt$y)) # y - y평균dt1$x_barx2 <- dt1$x_barx^2 # x 편차의 제곱

dt1$y_bary2 <- dt1$y_bary^2 # y편차의 제곱

dt1$xy <-dt1$x_barx * dt1$y_barydt1| i | x | y | x_barx | y_bary | x_barx2 | y_bary2 | xy |

|---|---|---|---|---|---|---|---|

| <int> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> |

| 1 | 4 | 9 | -4 | -9.6 | 16 | 92.16 | 38.4 |

| 2 | 8 | 20 | 0 | 1.4 | 0 | 1.96 | 0.0 |

| 3 | 9 | 22 | 1 | 3.4 | 1 | 11.56 | 3.4 |

| 4 | 8 | 15 | 0 | -3.6 | 0 | 12.96 | 0.0 |

| 5 | 8 | 17 | 0 | -1.6 | 0 | 2.56 | 0.0 |

| 6 | 12 | 30 | 4 | 11.4 | 16 | 129.96 | 45.6 |

| 7 | 6 | 18 | -2 | -0.6 | 4 | 0.36 | 1.2 |

| 8 | 10 | 25 | 2 | 6.4 | 4 | 40.96 | 12.8 |

| 9 | 6 | 10 | -2 | -8.6 | 4 | 73.96 | 17.2 |

| 10 | 9 | 20 | 1 | 1.4 | 1 | 1.96 | 1.4 |

round(colSums(dt1),3)- i

- 55

- x

- 80

- y

- 186

- x_barx

- 0

- y_bary

- 0

- x_barx2

- 46

- y_bary2

- 368.4

- xy

- 120

### hat beta1 = S_xy / S_xx

##hat beta0 = bar y - hat beta_1 * bar x

beta1 <- as.numeric(colSums(dt1)[8]/colSums(dt1)[6])

beta0 <- mean(dt$y) - beta1 * mean(dt$x)cat("hat beta0 = ", beta0)

cat("hat beta1 = ", beta1)hat beta0 = -2.269565hat beta1 = 2.608696평균반응, 개별 y 추정

구분할 수 있어야 한다

신뢰구간 달라진다.

## E(Y|x0) 평균반응

## y = E(Y|x0) + epsilon 개별 y 추정

# x0 = 4.5

new_dt <- data.frame(x = 4.5)# hat y0 = hat beta0 + hat beta1 * 4.5

predict(model1,

newdata = new_dt,

interval = c("confidence"), level = 0.95)| fit | lwr | upr | |

|---|---|---|---|

| 1 | 9.469565 | 5.79826 | 13.14087 |

new_data=new_df 정의 안 하면 fitted value가 나온다.

confidence는 평균반응

predict(model1, newdata = new_dt,

interval = c("prediction"), level = 0.95)| fit | lwr | upr | |

|---|---|---|---|

| 1 | 9.469565 | 2.379125 | 16.56001 |

prediction은 개별 y 추정

신뢰구간이 커진다.

dt_pred <- data.frame(

x = 1:12,

predict(model1,

newdata=data.frame(x=1:12),

interval="confidence", level = 0.95))

dt_pred| x | fit | lwr | upr | |

|---|---|---|---|---|

| <int> | <dbl> | <dbl> | <dbl> | |

| 1 | 1 | 0.3391304 | -6.2087835 | 6.887044 |

| 2 | 2 | 2.9478261 | -2.7509762 | 8.646628 |

| 3 | 3 | 5.5565217 | 0.6905854 | 10.422458 |

| 4 | 4 | 8.1652174 | 4.1058891 | 12.224546 |

| 5 | 5 | 10.7739130 | 7.4756140 | 14.072212 |

| 6 | 6 | 13.3826087 | 10.7597808 | 16.005437 |

| 7 | 7 | 15.9913043 | 13.8748223 | 18.107786 |

| 8 | 8 | 18.6000000 | 16.6817753 | 20.518225 |

| 9 | 9 | 21.2086957 | 19.0922136 | 23.325178 |

| 10 | 10 | 23.8173913 | 21.1945634 | 26.440219 |

| 11 | 11 | 26.4260870 | 23.1277880 | 29.724386 |

| 12 | 12 | 29.0347826 | 24.9754543 | 33.094111 |

dt_pred2 <- as.data.frame(predict(model1,

newdata=data.frame(x=1:12),

interval="prediction", level = 0.95))

dt_pred2| fit | lwr | upr | |

|---|---|---|---|

| <dbl> | <dbl> | <dbl> | |

| 1 | 0.3391304 | -8.5867330 | 9.264994 |

| 2 | 2.9478261 | -5.3751666 | 11.270819 |

| 3 | 5.5565217 | -2.2199297 | 13.332973 |

| 4 | 8.1652174 | 0.8663128 | 15.464122 |

| 5 | 10.7739130 | 3.8692308 | 17.678595 |

| 6 | 13.3826087 | 6.7738957 | 19.991322 |

| 7 | 15.9913043 | 9.5667143 | 22.415894 |

| 8 | 18.6000000 | 12.2379683 | 24.962032 |

| 9 | 21.2086957 | 14.7841056 | 27.633286 |

| 10 | 23.8173913 | 17.2086783 | 30.426104 |

| 11 | 26.4260870 | 19.5214047 | 33.330769 |

| 12 | 29.0347826 | 21.7358781 | 36.333687 |

names(dt_pred2)[2:3] <- c('plwr', 'pupr')plot 같이 그리게 데이터 합치기

dt_pred3 <- cbind.data.frame(dt_pred, dt_pred2[,2:3])barx <- mean(dt$x)

bary <- mean(dt$y)plot(y~x, data = dt,

xlab = "광고료",

ylab = "총판매액",

pch = 20,

cex = 2,

col = "grey",

ylim = c(min(dt_pred3$plwr), max(dt_pred3$pupr)))

abline(model1, lwd = 5, col = "darkorange")

lines(dt_pred3$x, dt_pred3$lwr, col = "dodgerblue", lwd = 3, lty = 2)

lines(dt_pred3$x, dt_pred3$upr, col = "dodgerblue", lwd = 3, lty = 2)

lines(dt_pred3$x, dt_pred3$plwr, col = "dodgerblue", lwd = 3, lty = 3)

lines(dt_pred3$x, dt_pred3$pupr, col = "dodgerblue", lwd = 3, lty = 3)

abline(h=bary,v=barx, lty=2, lwd=0.2, col='dark grey')

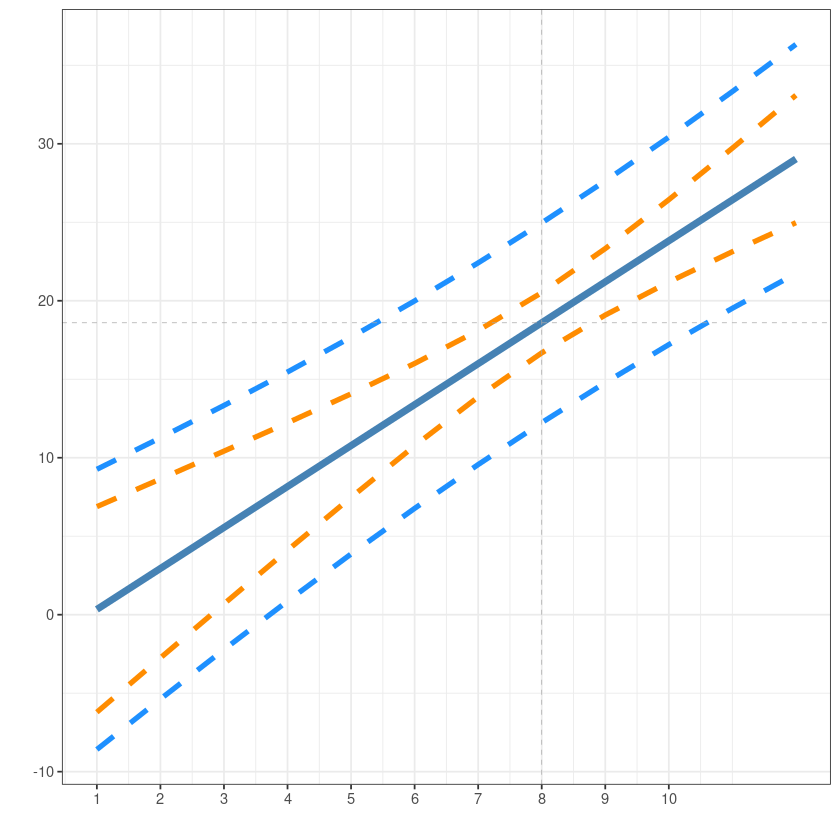

ggplot(dt_pred3, aes(x, fit)) +

geom_line(col='steelblue', lwd=2) +

xlab("")+ylab("")+

scale_x_continuous(breaks = seq(1,10))+

geom_line(aes(x, lwr), lty=2, lwd=1.5, col='darkorange') +

geom_line(aes(x, upr), lty=2, lwd=1.5, col='darkorange') +

geom_line(aes(x, plwr), lty=2, lwd=1.5, col='dodgerblue') +

geom_line(aes(x, pupr), lty=2, lwd=1.5, col='dodgerblue') +

geom_vline(xintercept = barx, lty=2, lwd=0.2, col='dark grey')+

geom_hline(yintercept = bary, lty=2, lwd=0.2, col='dark grey')+

theme_bw()

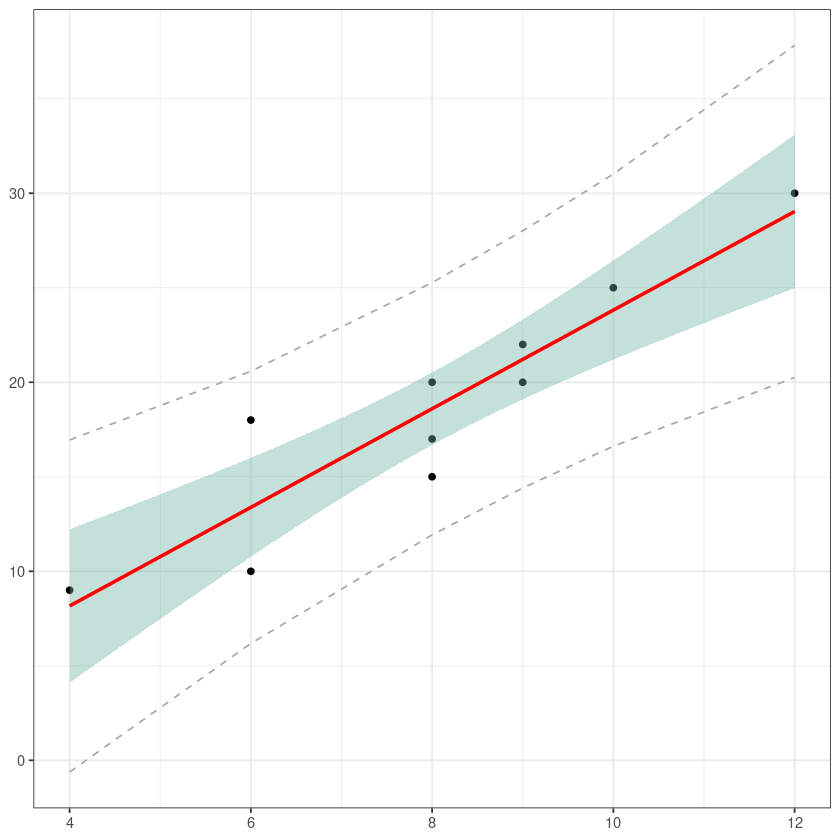

bb <- summary(model1)$sigma * ( 1 + 1/10 +(dt$x - 8)^2/46)

dt$ma95y <- model1$fitted + 2.306*bb

dt$mi95y <- model1$fitted - 2.306*bbggplot(dt, aes(x=x, y=y)) +

geom_point() +

geom_smooth(method=lm , color="red", fill="#69b3a2", se=TRUE) +

geom_line(aes(x, mi95y), col = 'darkgrey', lty=2) +

geom_line(aes(x, ma95y), col = 'darkgrey', lty=2) +

theme_bw() +

theme(axis.title = element_blank())`geom_smooth()` using formula 'y ~ x'

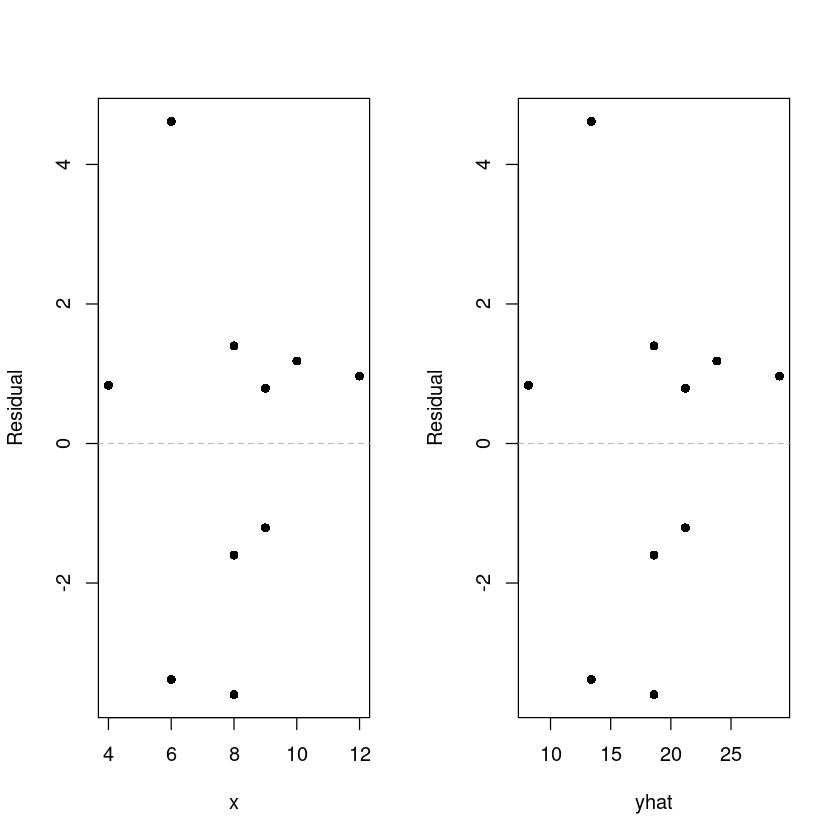

잔차분석

### epsilon : 선형성, 등분산성, 정규성, 독립성dt

dt$yhat <- model1$fitted

# fitted.values(model1) # y에 대한 추정값 구하기

dt$resid <- model1$residuals

# resid(model1)| x | y | ma95y | mi95y |

|---|---|---|---|

| <dbl> | <dbl> | <dbl> | <dbl> |

| 4 | 9 | 16.94766 | -0.6172208 |

| 8 | 20 | 25.27254 | 11.9274568 |

| 9 | 22 | 28.01311 | 14.4042841 |

| 8 | 15 | 25.27254 | 11.9274568 |

| 8 | 17 | 25.27254 | 11.9274568 |

| 12 | 30 | 37.81722 | 20.2523444 |

| 6 | 18 | 20.58263 | 6.1825918 |

| 10 | 25 | 31.01741 | 16.6173744 |

| 6 | 10 | 20.58263 | 6.1825918 |

| 9 | 20 | 28.01311 | 14.4042841 |

par(mfrow=c(1,2))

plot(resid ~ x, dt, pch=16, ylab = 'Residual')

abline(h=0, lty=2, col='grey')

plot(resid ~ yhat, dt, pch=16, ylab = 'Residual')

abline(h=0, lty=2, col='grey')

par(mfrow=c(1,1))

단순선형에서는 두 plot의 차이가 없다.

- 선형성 만족

- 등분산성 나름 만족

- 정규성 아웃라이어 있는 거 같은데..

- 독립성?

# 독립성검정 : DW test

library(lmtest)Loading required package: zoo

Attaching package: ‘zoo’

The following objects are masked from ‘package:base’:

as.Date, as.Date.numeric

##

dwtest(model1, alternative = "two.sided") #H0 : uncorrelated vs H1 : rho != 0

# dwtest(model1, alternative = "greater") #H0 : uncorrelated vs H1 : rho > 0

# dwtest(model1, alternative = "less") #H0 : uncorrelated vs H1 : rho < 0

Durbin-Watson test

data: model1

DW = 1.4679, p-value = 0.3916

alternative hypothesis: true autocorrelation is not 0p 값 커서 기각할 수 없다.

첫 번째꺼 주로 보기

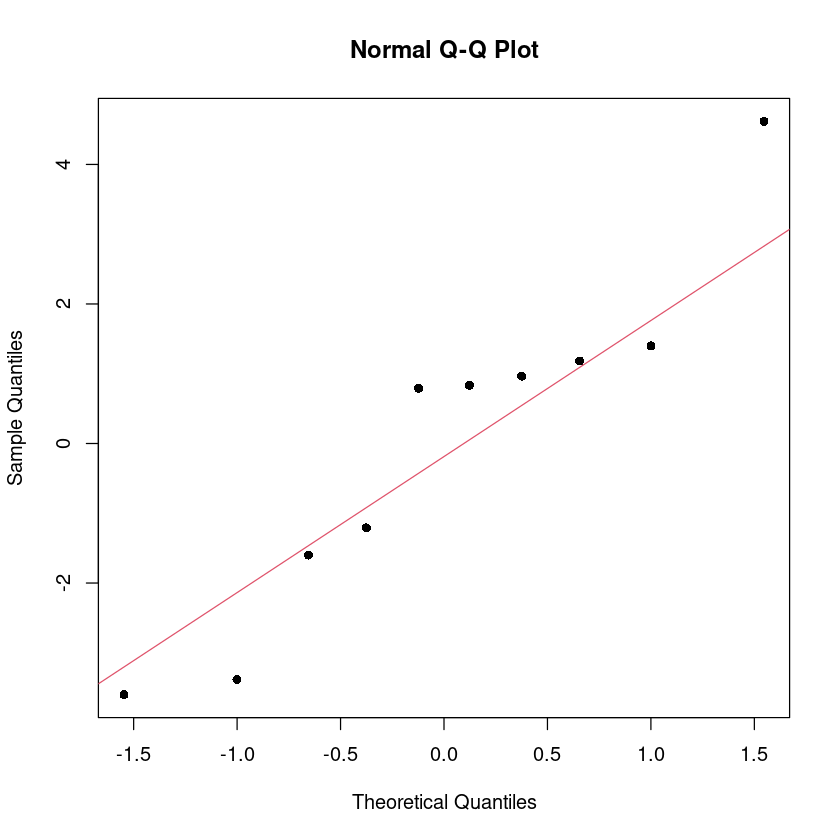

## 정규분포 (QQ plot)

qqnorm(dt$resid, pch=16)

qqline(dt$resid, col = 2)

분위수분위수 그림 - 정규분포의 실제 - 어떤 분포의 이론적 분위수와 내가 가진 sample의 분위수 비교

주로 꼬리쪽을 많이 본다. - 이 데이터의 경우 꼬리부분이 차이가 커 보임

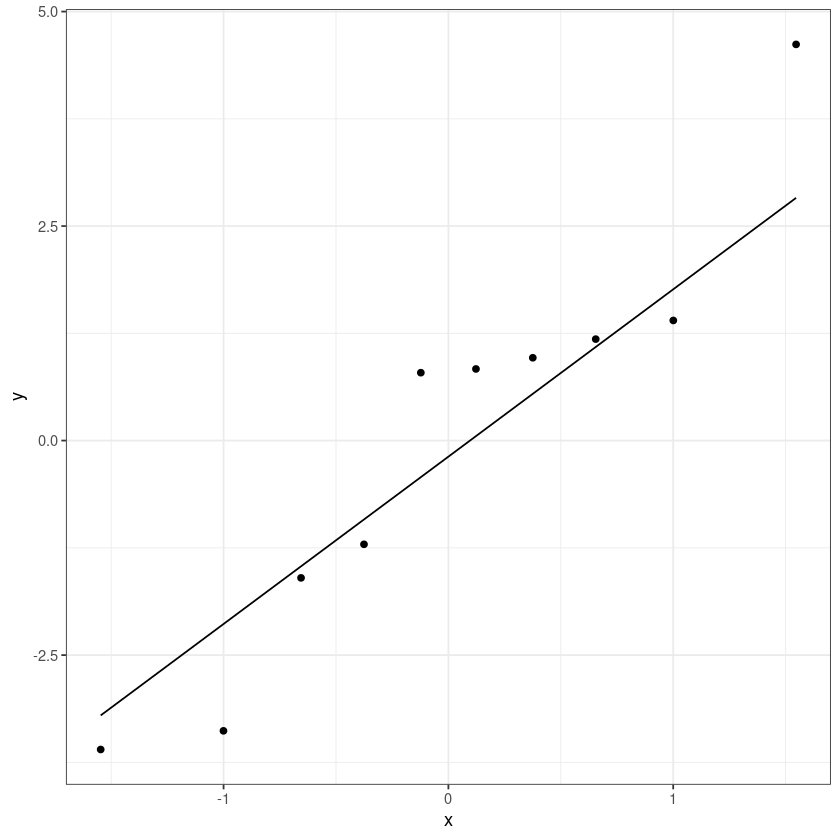

ggplot(dt, aes(sample = resid)) +

stat_qq() + stat_qq_line() +

theme_bw()

## 정규분포 검정

shapiro.test(dt$resid) ##shapiro-wilk test

#H0 : normal distributed vs H1 : not

Shapiro-Wilk normality test

data: dt$resid

W = 0.92426, p-value = 0.3939p값 작게 나오면 정규분포라고 하기 어렵다.

- 정규성은 잔차를 넣어줬는데

- bptest는 model을 넣었다.

## 등분산성 검정

bptest(model1) #Breusch–Pagan test

# H0 : 등분산 vs H1 : 이분산

studentized Breusch-Pagan test

data: model1

BP = 1.6727, df = 1, p-value = 0.1959책 예제

# install.packages('UsingR')

library(UsingR)Loading required package: MASS

Loading required package: HistData

Loading required package: Hmisc

Loading required package: lattice

Loading required package: survival

Loading required package: Formula

Attaching package: ‘Hmisc’

The following objects are masked from ‘package:base’:

format.pval, units

Attaching package: ‘UsingR’

The following object is masked from ‘package:survival’:

cancer

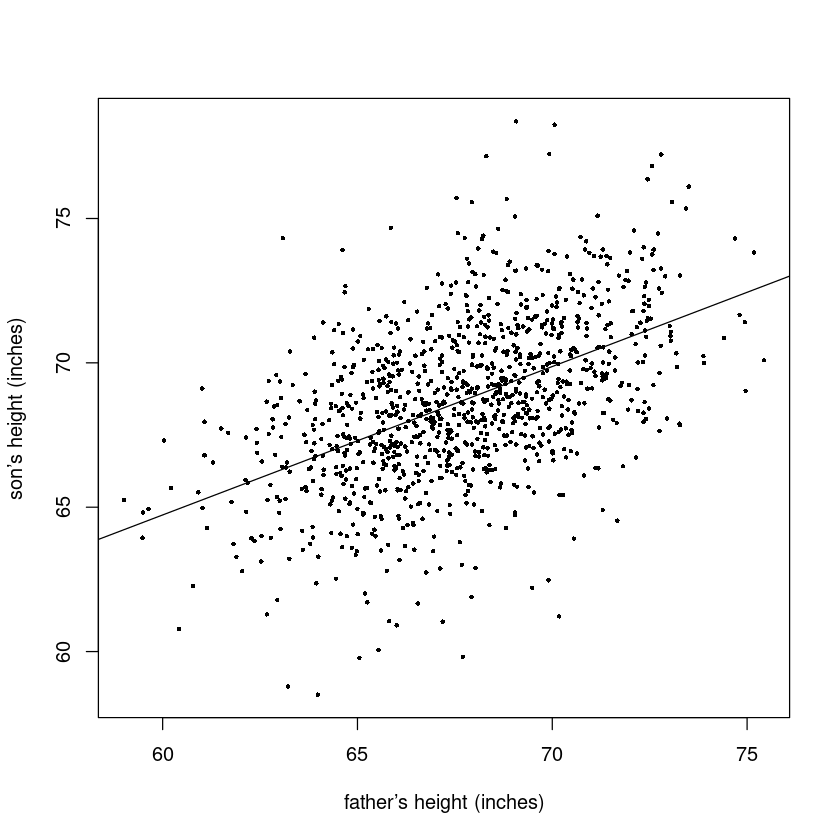

data(father.son)names(father.son)- 'fheight'

- 'sheight'

lm.fit<-lm(sheight~fheight, data=father.son)summary(lm.fit)

Call:

lm(formula = sheight ~ fheight, data = father.son)

Residuals:

Min 1Q Median 3Q Max

-8.8772 -1.5144 -0.0079 1.6285 8.9685

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 33.88660 1.83235 18.49 <2e-16 ***

fheight 0.51409 0.02705 19.01 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 2.437 on 1076 degrees of freedom

Multiple R-squared: 0.2513, Adjusted R-squared: 0.2506

F-statistic: 361.2 on 1 and 1076 DF, p-value: < 2.2e-16아버지의 키가 아들의 키의 25%만 설명

plot(sheight~fheight,

data=father.son,

pch=16, cex=0.5,

xlab="father’s height (inches)",

ylab="son’s height (inches)")

abline(lm.fit)

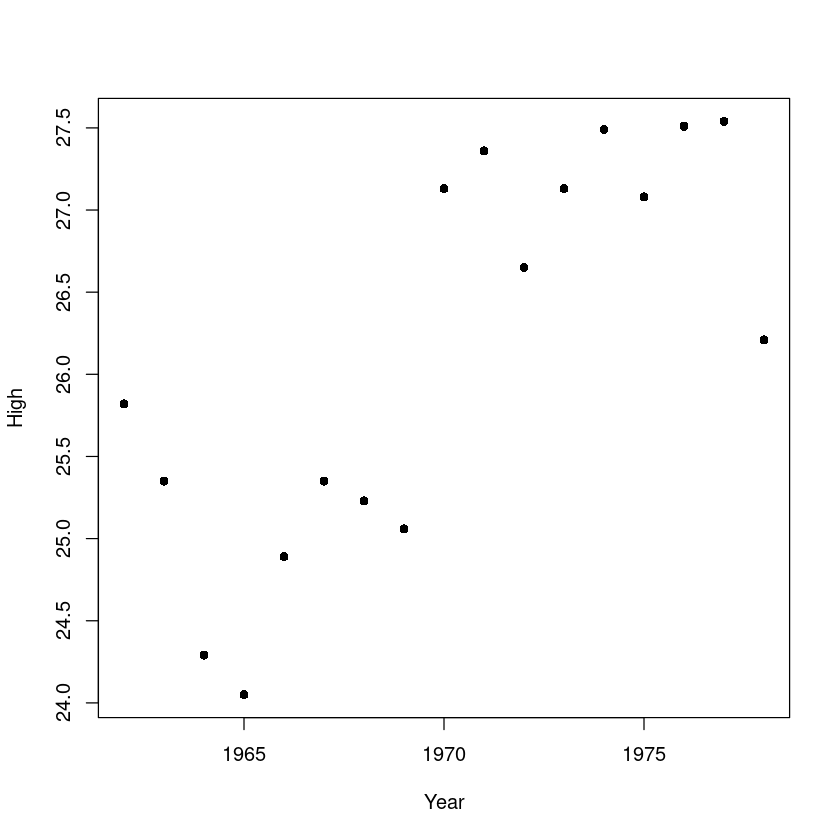

amazon<-read.csv("amazon.csv")

plot(High ~Year , amazon, pch=16)

lm.fit<-lm(High~Year, data=amazon)

summary(lm.fit)

confint(lm.fit)

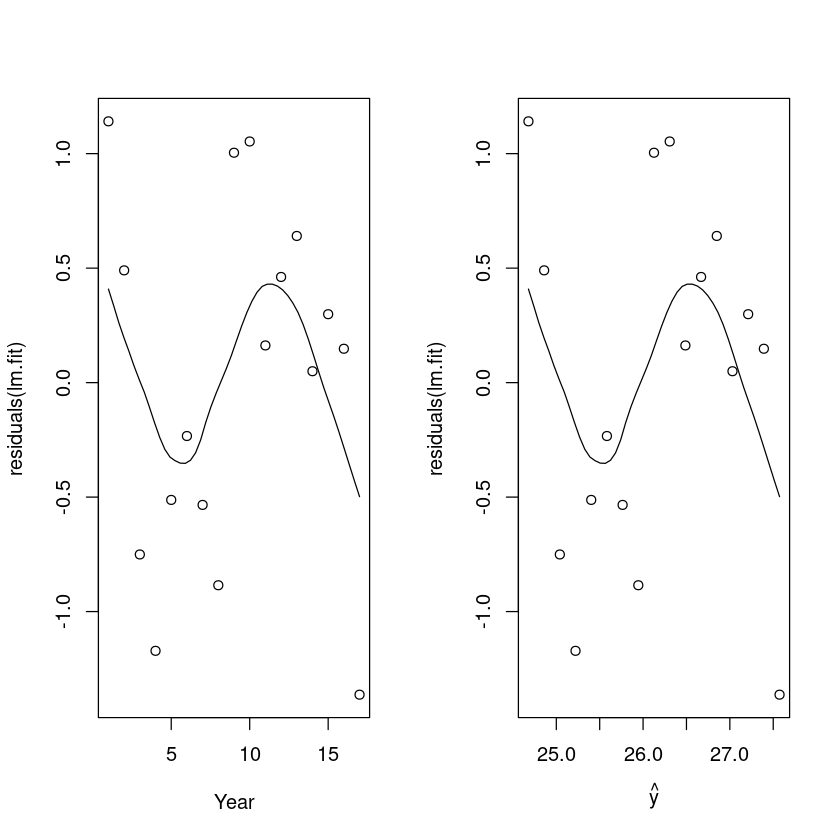

par(mfrow=c(1,2))

scatter.smooth(x=1:length(amazon$Year), y=residuals(lm.fit), xlab="Year")

scatter.smooth(x=predict(lm.fit), y=residuals(lm.fit), xlab=expression(hat(y)))

library(lmtest)

dwtest(lm.fit)

Call:

lm(formula = High ~ Year, data = amazon)

Residuals:

Min 1Q Median 3Q Max

-1.3629 -0.5341 0.1479 0.4903 1.1412

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -330.21235 78.03319 -4.232 0.000725 ***

Year 0.18088 0.03961 4.567 0.000371 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.8001 on 15 degrees of freedom

Multiple R-squared: 0.5816, Adjusted R-squared: 0.5537

F-statistic: 20.85 on 1 and 15 DF, p-value: 0.0003708| 2.5 % | 97.5 % | |

|---|---|---|

| (Intercept) | -496.53615985 | -163.8885460 |

| Year | 0.09645429 | 0.2653104 |

Durbin-Watson test

data: lm.fit

DW = 1.0487, p-value = 0.006864

alternative hypothesis: true autocorrelation is greater than 0

양의 상관관계가 있다. - 시간순 index - 최근 관측 데이터에 영향 많이 받는 편